Financial Information

Tax Information

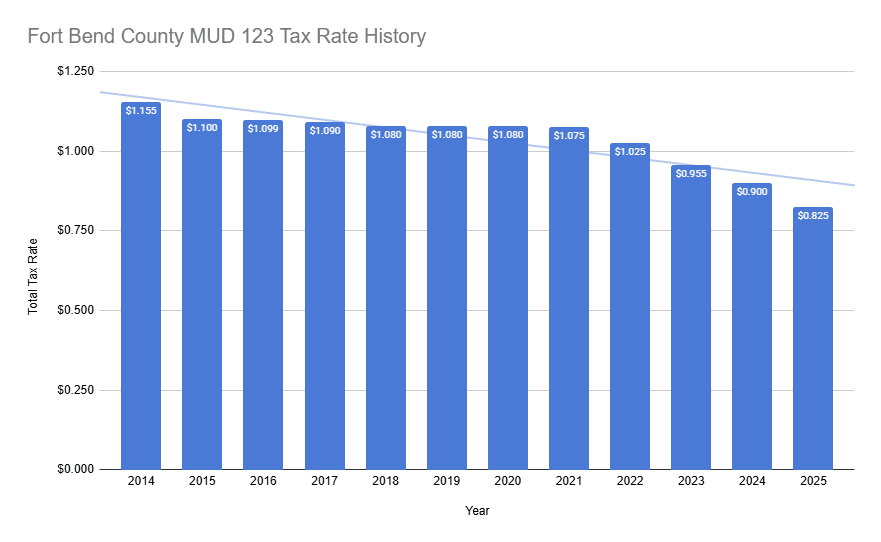

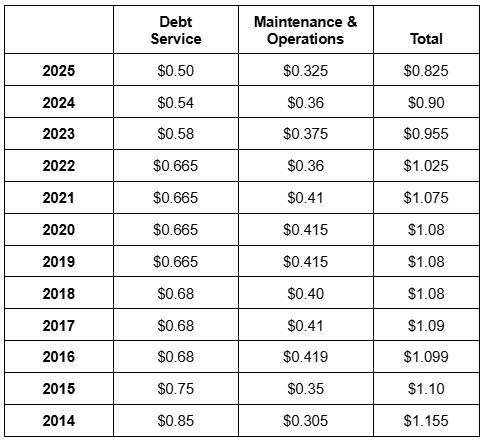

Historical Tax Rate

Fort Bend County MUD 123 Ad Valorem Taxes rates are based on property values established by the http://www.fbcad.org/Fort Bend Central Appraisal District. The tax rate (below) is per $100 of home value, as determined by the Fort Bend Central Appraisal District.

Tax Statement

If you have not received your tax statement and you do not escrow your taxes, please contact the Tax Office at 281-499-1223 or visit their website at https://www.taxtech.net/www.taxtech.net.

Budget Information

Budget for the Current and Prior Years

2025 Budget - FB123Approved Budget - 2025

2024 Budget - FB123Approved Budget - 2024

2023 Budget - FB123Approved Budget - 2023

Approved Budget - 2022

Change in the District's Revenue from 2020 to 2021 : $ 132,803.00 | 6.36% Change in the District's Expenses from 2020 to 2021: $ 112,930.00 | 7.10%

Property Tax Revenue Budgeted for Maintenance & Operations and for Debt Service

2021

Debt Service: $ 1,489,914.00

Maintenance & Operations: $ 1,001,839.00

2020

Debt Service: $ 1,438,184.00

Maintenance & Operations: $ 938,476.00

2019

Debt Service: $ 1,457,124.00

Maintenance & Operations: $ 910,703.00